05.12.2016

Euro

General overview

The euro edged lower on Friday amid Germany bonds market weakness. Moreover, traders were cautious ahead of US unemployment data and Italian referendum. Nonfarm Payrolls disappointed markets with its mixed figures. The number of jobs grew while the unemployment rate fell in the country.

Current situation

The market remained positive on Friday. The euro met a barrier around 1.0700 and bounced off the level after two-day rally ahead of the European opening. The pair declined and tested 1.0650 post-Europe open and stayed at the level ahead of the NY opening. A new buying interest pushed prices towards 1.0700. The 4 hours chart showed that the price grew and tested the 100-EMA in the European session. EUR/USD bounced off the moving and surged lower ahead of the NY opening. The price was between the 50 and 100 EMAs during the New York session. The resistance is at 1.0700, the support comes in at 1.0650.

The MACD histogram grew which indicates buyers’ strength. The RSI remained within overbought readings.

Trading recommendations

We expect the pair to maintain its bearish tone. A break below 1.0600 might force the euro to resume its downward trajectory towards 1.0500. Alternatively, we do not rule out a short term growth towards 1.0750.

Pound

General overview

The pound moved higher on Friday amid better-than-expected UK’s Construction PMI. However its growth was limited by the US labor market mixed data.

Current situation

After refreshing November high at 1.2700 the pound softened to the 1.2600 support area where buyers found a solid support to take a breath. Traders made another attempt to buy sterling in the NY session. The pair bounced off the level 1.2600 and trended upwards to the recent highs. The price continued developing well above the moving averages which all pointed higher. The resistance lies at 1.2700, the support comes in at 1.2600.

MACD remained at the same level which confirms the strength of buyers. RSI oscillator stayed near overbought levels, favoring a new move higher.

Trading recommendations

If the current resistance breaks, the price may grow further that should send this market looking for the 1.28 level. A return below 1.2600 will question buyers' strength and may cause a sell-off to the 1.25 - 1.24 region.

Yen

General overview

The dollar did not take advantage of a weaker yen and softened on Friday.

Current situation

The USD/JPY pair remained in an upward channel. Buyers seem to be consolidating their gains, accumulating strength for a new upward impetus. The price moved away from the upper limit of the channel and headed towards 113.00 on Friday. The moving averages slightly changed from Friday. The price stayed above the moving averages which all pointed higher. The resistance is highlighted at 114.00, the support comes in at 113.00.

MACD decreased which indicates the buyers’ positions weakening. RSI moved from the overbought levels.

Trading recommendations

Once we break above the 114.00 level, we think that the 115.00 level will be next. However, inability to refresh highs may cause a sell-off towards 112.00.

USD/CAD

General overview

The mixed U.S. unemployment data weighed on the dollar across the board giving additional upward momentum to its Canadian peer. Moreover, oil prices retracement from 16-month high helped the USD/CAD to retake 1.33 level and to extend losses.

Current situation

USD/CAD opened on a weaker note and maintained a gloomy tone on Friday. After a brief consolidation phase during the European hours traders pushed the price towards 1.3260. The pair met a barrier around the level and rolled back immediately after the test. The price broke the 200-EMA on its way downwards in the 4 hours chart. The 200-EMA kept heading higher, while 50 and 100 EMAs pointed lower. The resistance is at 1.3330, the support comes in at 1.3260.

The MACD histogram decreased which indicates the sellers’ strength. The RSI indicator was holding near oversold levels, favoring a new move lower.

Trading recommendations

The level 1.3260 slowed down dollar weakness. A cut through here will aim at the 1.3190 level. Conversely, if the level 1.3260 holds and reject prices the dollar may recover towards 1.3400.

XAU/USD

General overview

Despite the dollar retracement across the board Gold remained unmoved on Friday as risk on sentiments prevailed.

Current situation

Gold prices struggled for a direction on Friday staying between the current support and resistance. The price moved back and forth between 1180 - 1170 during the day. The pair continued developing well below the moving averages. The price broke 50-EMA and stopped half way towards the 100-EMA in the 1 hour chart. The moving averages maintained their bearish slope. The resistance exists at 1180, the support stands at 1170 dollars per ounce.

MACD was in the negative territory. If MACD remains in the negative territory, sellers’ positions will strengthen. RSI was in a neutral area.

Trading recommendations

We prefer to stay neutral for now. We expect further sideways trades in the coming days.

Brent

General overview

Oil prices moved lower on Friday amid profit-taking and doubts that the recent OPEC agreement will be able to rein in a global glut.

Current situation

Oil prices traded mixed on Friday. The price moved lower in the European session and found some support above 52.50 dollars per barrel. The price bounced off the level and edged higher during the NY hours. The benchmark returned to 16-month high post-US open. The price hovered above the 50, 100 and 200 EMAs in the 4 hours chart. The 200-EMA was neutral while the 50 and 100 EMAs moved higher. The resistance lies at 55.50, the support comes in at 53.50 dollars per barrel.

MACD remained at the same level which confirms the strength of buyers. RSI consolidated within positive territory.

Trading recommendations

If a positive mood persists oil prices will extend their upward momentum towards 55.50. At the same time a firm break below 53.50 handle would open the way to 50.50 dollars per barrel.

DAX

General overview

European stocks traded higher on Friday despite the uncertainty over the Italian referendum. Oil prices steady growth and the U.S. dollar retracement supported stocks in the EU.

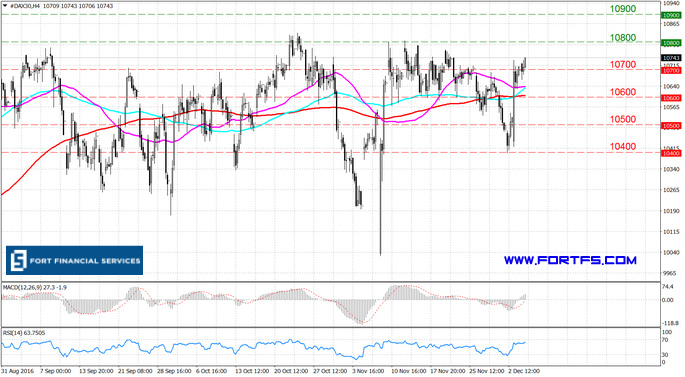

Current situation

DAX gapped lower on Friday. The price jumped from 10480 to 10470 in early Asian trades. The index extended its losses after the gap and reached 10400 post-Europe open. The benchmark tested the level 10400 and bounced off the level right after the test. The price rallied to 10500 and filled the midnight gap ahead of NY opening. The price broke the 100 and 200 EMAs in the 4-hours char on its way downwards. The 100 and 200 EMAs were neutral while the 50-EMA headed lower. The resistance exists at 10600, the support stands at 10500.

MACD grew which indicates the sellers’ positions weakening. The RSI indicator bounced off the oversold territory.

Trading recommendations

If bulls take control the DAX index is expected to rise towards 10600.

NASDAQ

General overview

Despite the disappointed US labor data the US stocks traded higher on Friday getting firm support from oil prices strength.

Current situation

The index opened lower on Friday but was able to reverse some of its losses during the day. The price met a barrier around 4710 which rejected the benchmark upwards. The price grew and broke 4740 during the NY session. After the break NASDAQ Composite extended its gains towards 4740. The index remained below moving averages in the 4 hours chart. The 100 and 200 EMAs remained neutral while the 50-EMA turned lower. The resistance is at 4770, the support comes in at 4740.

MACD grew which indicates the sellers’ positions weakening. RSI bounced off the oversold area.

Trading recommendations

A further recovery towards 4770 will neutralize the current downward pressure. If a positive tone persists the benchmark will extend its recovery towards 4800

*Analytical review is presented by the leading analyst of the broker Fort Financial Services, Alexander Kofman